April 4, 2025 by Cormint

BENCHMARKING 2024 RESULTS

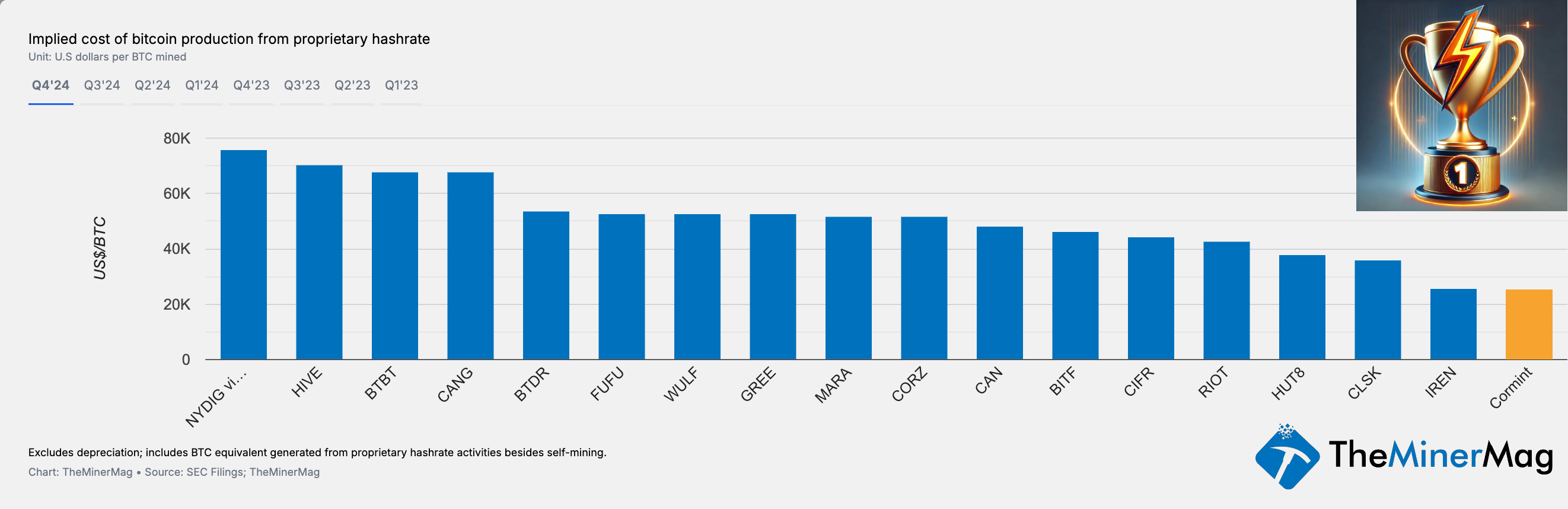

Cormint was ranked 1st by The Miner Mag for Q4 2024 Implied cost of bitcoin production from proprietary hashrate ahead of 19 competitors including the largest names in the industry. This is the 6th time Cormint has achieved pole position out of the past 8 quarters on this measure.

The team set out to become America’s lowest cost producer of Bitcoin. With a culture of frugality, and deep competencies in power, engineering, and capital markets, the results speak for themselves. While these results focus on our operational costs to mine Bitcoin, Cormint believes that it also leads the industry in terms of its capital expenditure per MW to deploy new capacity.

Our investors expect a return materially greater than what they would have achieved with a passive investment into Bitcoin, and that is what we are all about.

Please note that this press release is for informational purposes only and it does not represent an offer to sell or the solicitation of an offer to buy any of Cormint’s securities.

This press release contains a number of forward-looking statements. Words such as “expect,” “will,” “working,” “plan” and variations of such words and similar future or conditional expressions are intended to identify forward-looking statements. These forward-looking statements reflect Cormint’s current views with respect to, among other things, future events. These forward-looking statements are not guarantees of future results and are subject to a number of risks and uncertainties, many of which are difficult to predict and beyond Cormint’s control. Important factors that may cause actual results to differ materially from those in the forward-looking statements include, but are not limited to Cormint’s ability to deliver and execute on its strategic plans; Cormint’s ability to maintain free cash flows and increase its operating margins and other risks related to Bitcoin mining.